H.R.692 — China Exchange Rate Transparency Act of 2025

House Roll Call

H.R.692

Roll 36 • Congress 119, Session 1 • Feb 10, 2025 6:49 PM • Result: Passed

← Back to roll call list • View bill page • Clerk record • API source

| Bill | H.R.692 — China Exchange Rate Transparency Act of 2025 |

|---|---|

| Vote question | On Motion to Suspend the Rules and Pass, as Amended |

| Vote type | 2/3 Yea-And-Nay |

| Result | Passed |

| Totals | Yea 388 / Nay 7 / Present 0 / Not Voting 38 |

| Party | Yea | Nay | Present | Not Voting |

|---|---|---|---|---|

| R | 196 | 7 | 0 | 15 |

| D | 192 | 0 | 0 | 23 |

| I | 0 | 0 | 0 | 0 |

Research Brief

On Motion to Suspend the Rules and Pass, as Amended

Bill Analysis

Bill Summary: HR 692 - China Exchange Rate Transparency Act of 2025

The China Exchange Rate Transparency Act of 2025 aims to enhance the transparency and accountability of China’s currency exchange rate policies. The bill mandates the U.S. Department of the Treasury to conduct a comprehensive assessment of China’s exchange rate practices and their impact on U.S. trade and economic interests.

Key Provisions:

- The Treasury Secretary is required to report annually to Congress on China’s currency manipulation, including an evaluation of the Chinese yuan’s valuation against the U.S. dollar and other major currencies.

- The bill establishes criteria for determining whether China is manipulating its currency to gain an unfair trade advantage, including examining the trade balance, foreign exchange reserves, and the extent of intervention in currency markets.

- If the Treasury identifies currency manipulation, it is directed to engage with international partners to address these practices and may impose trade remedies to counteract the effects on U.S. industries.

Funding and Authorities: The bill does not allocate specific funding but requires the Treasury Department to utilize existing resources to fulfill the reporting and assessment obligations. It also empowers the Treasury to collaborate with the International Monetary Fund (IMF) and other international bodies to enhance global currency stability.

Affected Programs and Agencies: The primary agency impacted is the U.S. Department of the Treasury, which will oversee the implementation of the bill’s provisions. The bill also engages the Office of the U.S. Trade Representative and the Department of Commerce in addressing trade implications.

Beneficiaries and Regulation: U.S. manufacturers, exporters, and workers are the primary beneficiaries, as enhanced transparency may lead to fairer trade practices and reduced competitive disadvantages stemming from currency manipulation. The bill also aims to regulate China’s currency practices, promoting a more equitable trading environment.

Key Timelines: The bill was introduced in the House and has been received in the Senate, where it has been read twice and referred to the Committee on Foreign Relations for further consideration. The timeline for subsequent actions remains to be determined.

Yea (388)

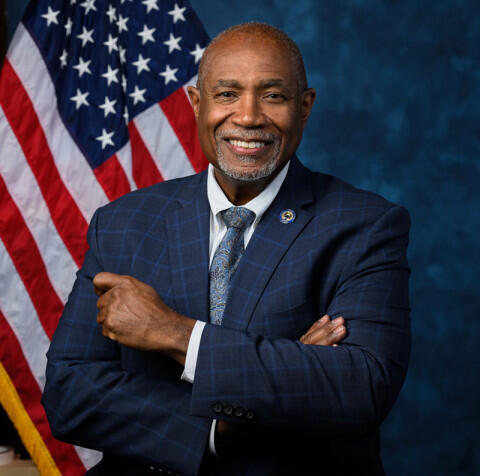

AL • R • Yea

CA • D • Yea

MO • R • Yea

GA • R • Yea

RI • D • Yea

NV • R • Yea

AZ • D • Yea

TX • R • Yea

MA • D • Yea

TX • R • Yea

NE • R • Yea

IN • R • Yea

OH • R • Yea

VT • D • Yea

CA • D • Yea

MI • R • Yea

WA • R • Yea

FL • R • Yea

OH • D • Yea

AK • R • Yea

OR • R • Yea

CA • D • Yea

MI • R • Yea

VA • D • Yea

OK • R • Yea

SC • R • Yea

FL • R • Yea

GA • D • Yea

OR • D • Yea

IL • R • Yea

PA • D • Yea

OK • R • Yea

PA • R • Yea

OH • D • Yea

CA • D • Yea

FL • R • Yea

IL • D • Yea

MO • R • Yea

OR • D • Yea

CA • R • Yea

FL • R • Yea

CA • D • Yea

OH • R • Yea

IN • D • Yea

TX • R • Yea

GA • R • Yea

TX • D • Yea

HI • D • Yea

IL • D • Yea

FL • D • Yea

TX • D • Yea

FL • D • Yea

CA • D • Yea

CA • D • Yea

MA • D • Yea

NY • D • Yea

VA • R • Yea

SC • D • Yea

GA • R • Yea

TN • D • Yea

OK • R • Yea

GA • R • Yea

KY • R • Yea

NJ • D • Yea

VA • D • Yea

CA • D • Yea

CA • D • Yea

CT • D • Yea

MN • D • Yea

CO • R • Yea

AR • R • Yea

TX • R • Yea

TX • D • Yea

CO • D • Yea

TX • D • Yea

KS • D • Yea

OH • R • Yea

IL • D • Yea

NC • D • Yea

TX • R • Yea

PA • D • Yea

CO • D • Yea

CT • D • Yea

WA • D • Yea

PA • D • Yea

CA • D • Yea

FL • R • Yea

MI • D • Yea

TX • D • Yea

FL • R • Yea

FL • R • Yea

MD • D • Yea

TX • R • Yea

MN • R • Yea

TX • D • Yea

NY • D • Yea

KS • R • Yea

PA • D • Yea

CO • R • Yea

MS • R • Yea

TX • R • Yea

ND • R • Yea

IA • R • Yea

LA • D • Yea

AL • D • Yea

MN • R • Yea

MN • R • Yea

WI • R • Yea

PA • R • Yea

TN • R • Yea

TX • D • Yea

NE • R • Yea

CA • R • Yea

IL • D • Yea

NC • D • Yea

NC • R • Yea

FL • D • Yea

FL • R • Yea

CA • D • Yea

FL • D • Yea

SC • R • Yea

ID • R • Yea

CA • D • Yea

NY • R • Yea

TX • D • Yea

CA • D • Yea

IL • D • Yea

TX • R • Yea

NY • D • Yea

FL • R • Yea

ME • D • Yea

NY • D • Yea

TX • R • Yea

TX • R • Yea

TX • D • Yea

NH • D • Yea

MO • R • Yea

CA • D • Yea

TX • D • Yea

TN • R • Yea

GA • R • Yea

VA • R • Yea

WI • R • Yea

MS • R • Yea

KY • R • Yea

WY • R • Yea

AZ • R • Yea

CA • D • Yea

FL • R • Yea

NC • R • Yea

MD • R • Yea

NC • R • Yea

TN • R • Yea

CT • D • Yea

OK • R • Yea

LA • R • Yea

AR • R • Yea

CT • D • Yea

IA • R • Yea

NV • D • Yea

IN • R • Yea

PA • D • Yea

OR • D • Yea

NC • R • Yea

CO • R • Yea

CA • R • Yea

GA • R • Yea

TX • R • Yea

CA • D • Yea

MI • R • Yea

WA • D • Yea

NY • D • Yea

GA • D • Yea

LA • R • Yea

SD • R • Yea

TX • D • Yea

OH • R • Yea

PA • R • Yea

OH • D • Yea

NJ • R • Yea

PA • R • Yea

IL • D • Yea

MS • R • Yea

NY • D • Yea

UT • R • Yea

CA • D • Yea

VA • R • Yea

CA • R • Yea

CA • R • Yea

NC • R • Yea

IL • D • Yea

TN • R • Yea

IL • R • Yea

NY • R • Yea

NY • R • Yea

WA • D • Yea

NY • D • Yea

OH • R • Yea

NY • R • Yea

NV • D • Yea

FL • R • Yea

PA • D • Yea

LA • R • Yea

CA • D • Yea

CA • D • Yea

CA • D • Yea

CA • D • Yea

GA • R • Yea

OK • R • Yea

FL • R • Yea

TX • R • Yea

MA • D • Yea

SC • R • Yea

PA • R • Yea

NY • R • Yea

UT • R • Yea

KS • R • Yea

NY • D • Yea

FL • R • Yea

CA • D • Yea

GA • D • Yea

DE • D • Yea

TX • R • Yea

MI • R • Yea

MD • D • Yea

VA • D • Yea

MN • D • Yea

GA • R • Yea

MI • D • Yea

NC • R • Yea

KY • D • Yea

MA • D • Yea

VA • R • Yea

NJ • D • Yea

NY • D • Yea

NJ • D • Yea

NY • D • Yea

PA • R • Yea

MD • D • Yea

WV • R • Yea

IL • R • Yea

OH • R • Yea

FL • R • Yea

CA • D • Yea

MI • R • Yea

WI • D • Yea

AL • R • Yea

UT • R • Yea

WV • R • Yea

NC • R • Yea

TX • R • Yea

NY • D • Yea

MN • D • Yea

FL • D • Yea

MA • D • Yea

IN • D • Yea

NC • R • Yea

NY • D • Yea

MA • D • Yea

CO • D • Yea

TX • R • Yea

WA • R • Yea

NJ • D • Yea

SC • R • Yea

IA • R • Yea

CA • R • Yea

NY • D • Yea

TN • R • Yea

MD • D • Yea

MN • D • Yea

MO • R • Yea

UT • R • Yea

NJ • D • Yea

AL • R • Yea

CA • D • Yea

NH • D • Yea

CA • D • Yea

WA • D • Yea

PA • R • Yea

CA • D • Yea

TX • R • Yea

ME • D • Yea

WI • D • Yea

NJ • D • Yea

MA • D • Yea

IL • D • Yea

IL • D • Yea

WA • D • Yea

MD • D • Yea

PA • R • Yea

NY • D • Yea

CA • D • Yea

KY • R • Yea

AL • R • Yea

TN • R • Yea

NC • D • Yea

NC • R • Yea

CA • D • Yea

OH • R • Yea

FL • R • Yea

NY • D • Yea

FL • R • Yea

OR • D • Yea

CA • D • Yea

LA • R • Yea

PA • D • Yea

IL • D • Yea

KS • R • Yea

IL • D • Yea

MI • D • Yea

AZ • R • Yea

VA • D • Yea

GA • D • Yea

GA • R • Yea

TX • R • Yea

TX • R • Yea

AL • D • Yea

CA • D • Yea

IN • R • Yea

CA • D • Yea

ID • R • Yea

WA • D • Yea

NJ • R • Yea

NE • R • Yea

MO • R • Yea

PA • R • Yea

IL • D • Yea

FL • D • Yea

IN • R • Yea

NM • D • Yea

AZ • D • Yea

MN • R • Yea

NY • R • Yea

WI • R • Yea

FL • R • Yea

MI • D • Yea

WA • D • Yea

AL • R • Yea

IN • R • Yea

VA • D • Yea

NY • D • Yea

OH • D • Yea

CA • D • Yea

OH • R • Yea

NY • R • Yea

MI • D • Yea

MS • D • Yea

CA • D • Yea

PA • R • Yea

WI • R • Yea

SC • R • Yea

NV • D • Yea

MI • D • Yea

HI • D • Yea

NY • D • Yea

CA • D • Yea

NY • D • Yea

MA • D • Yea

CA • D • Yea

OH • R • Yea

TX • D • Yea

IL • D • Yea

CA • R • Yea

NJ • D • Yea

TX • R • Yea

WI • R • Yea

CA • D • Yea

NM • D • Yea

TX • D • Yea

NY • D • Yea

VA • D • Yea

MO • R • Yea

MI • R • Yea

FL • D • Yea

CA • D • Yea

NJ • D • Yea

TX • R • Yea

AR • R • Yea

CA • D • Yea

WI • R • Yea

GA • D • Yea

TX • R • Yea

SC • R • Yea

VA • R • Yea

AR • R • Yea

IN • R • Yea

MT • R • Yea

Nay (7)

AZ • R • Nay

CO • R • Nay

TN • R • Nay

AZ • R • Nay

AZ • R • Nay

KY • R • Nay

TX • R • Nay

Not Voting (38)

KY • R • Not Voting

MO • D • Not Voting

LA • D • Not Voting

AZ • R • Not Voting

MO • D • Not Voting

TX • R • Not Voting

TN • R • Not Voting

OR • D • Not Voting

MT • R • Not Voting

NC • R • Not Voting

CA • D • Not Voting

TX • R • Not Voting

NJ • D • Not Voting

AZ • D • Not Voting

MD • D • Not Voting

CA • D • Not Voting

MI • R • Not Voting

TX • R • Not Voting

MD • D • Not Voting

IL • D • Not Voting

OH • R • Not Voting

CA • D • Not Voting

MA • D • Not Voting

CA • R • Not Voting

OH • D • Not Voting

CT • D • Not Voting

NM • D • Not Voting

RI • D • Not Voting

CA • R • Not Voting

IN • R • Not Voting

IA • R • Not Voting

CA • D • Not Voting

CO • D • Not Voting

WA • D • Not Voting

NJ • D • Not Voting

CA • D • Not Voting

FL • R • Not Voting

FL • D • Not Voting